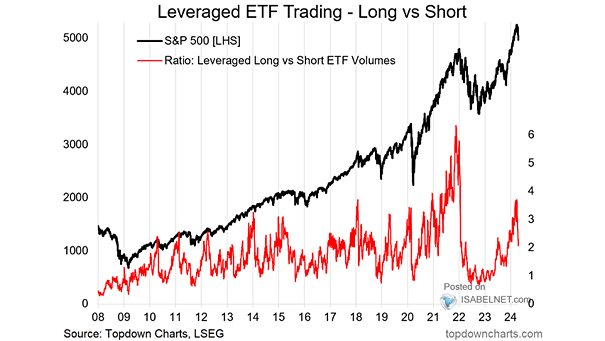

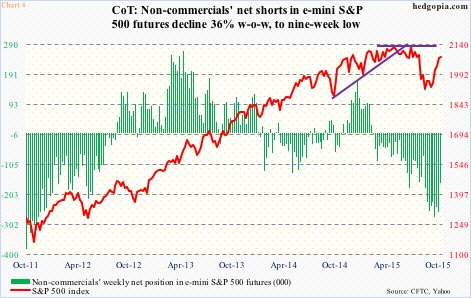

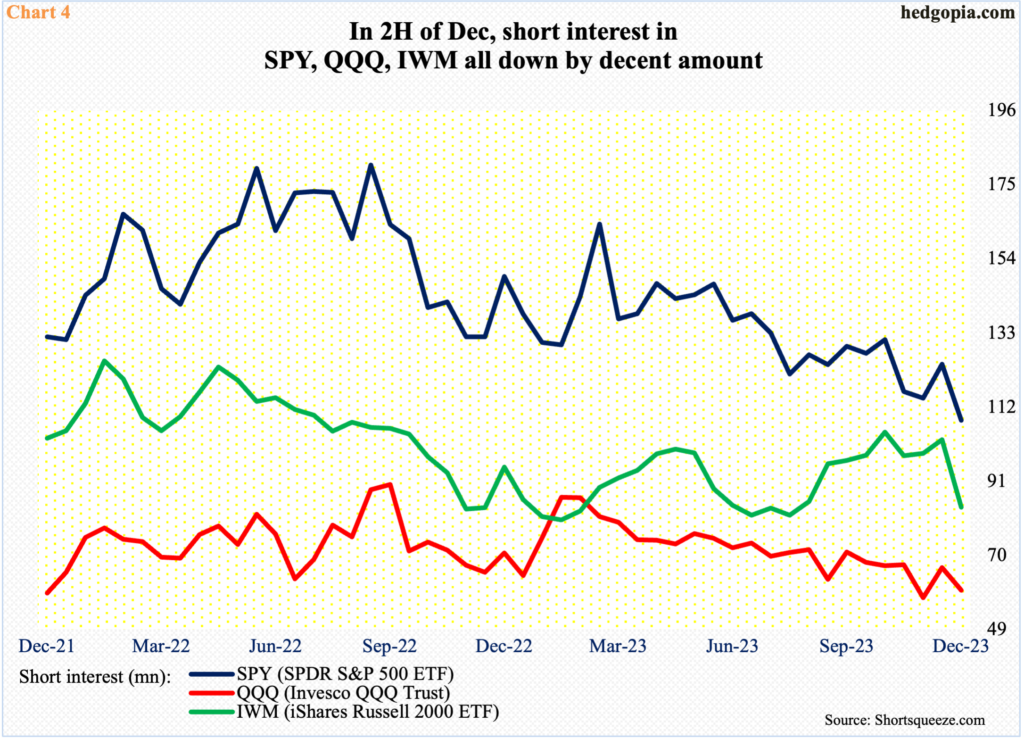

Post-Pivot Spike In S&P 500-Focused ETF Flows Losing Steam – Bound To Catch Up With US Equity Indices At/Near Highs – Hedgopia

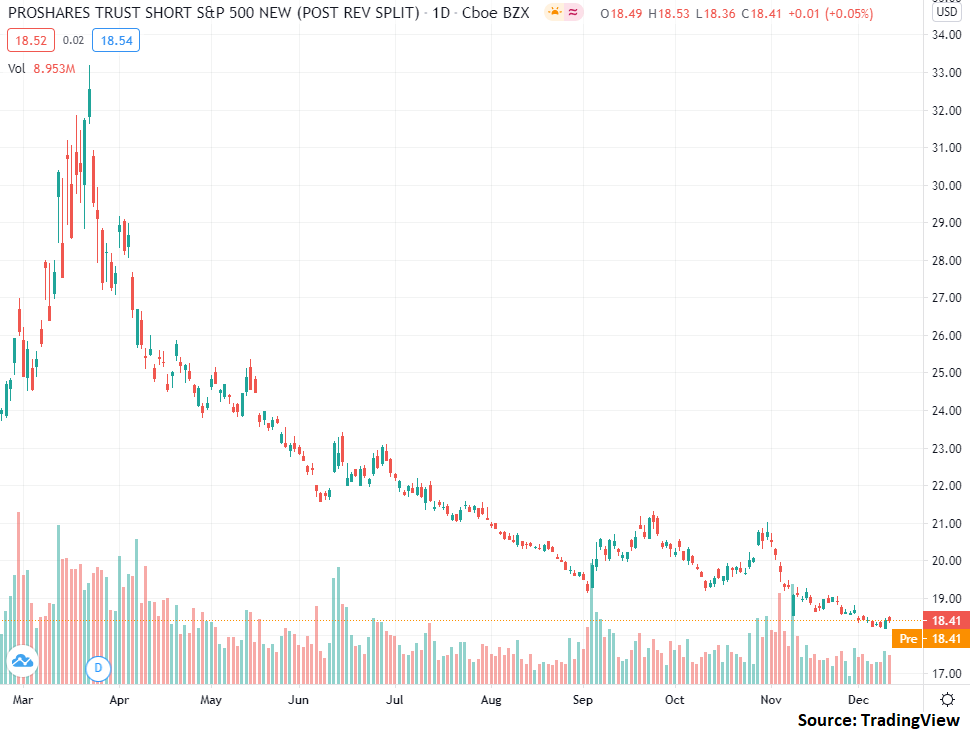

SPYV SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF Acciones - Precio de Acciones, Interés Corto, Apretón Corto, Tasas de Préstamo (ARCA)

Total long and short ETF adjusted rebalancing exposure versus the S&P 500. | Download Scientific Diagram

Total long and short ETF adjusted rebalancing exposure versus the S&P 500. | Download Scientific Diagram

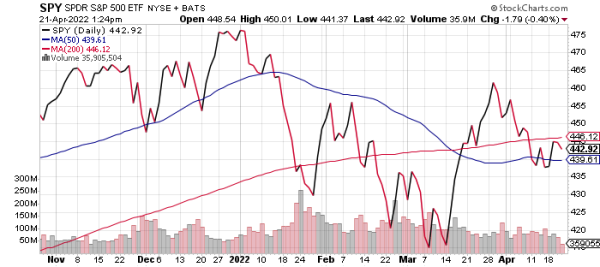

Jesse Felder on X: "Short interest on the S&P 500 ETF is near the lowest since early 2007 https://t.co/2frENCtfqG https://t.co/k05Nd9zq89" / X